FEDERAL BUDGET PROPOSES IMPROVEMENTS TO DISABILITY TAX CREDIT

Audrey Veltri, IG Wealth Management

April 2021

The 2021 Federal Budget announcement on April 19, 2021 was delivered by Canada’s Deputy Prime Minister and Minister of Finance Chrystia Freeland. The proposal unveiled a historic $101.5 billion dollars in new spending focused on many issues including extending pandemic supports, a national childcare plan, increases to minimum wage, an investment in climate change and green initiatives, and some much-needed changes to the Disability Tax Credit, DTC.

I couldn’t be happier. For years I have been advocating for changes to the federal Disability Tax Credit Program, particularly to the eligibility terms surrounding mental functions necessary for everyday life. And finally, some promising movement.

The details of the proposal are as follows.

-

An update to the list of mental functions which would qualify for eligibility.

Currently, under the category of metal functions necessary for everyday life, applicants must show a significant, prolonged and almost constant impairment in three areas; adaptive function, memory and problem solving/goal setting/judgment (taken together). These broad and uncertain categories have created challenges for many Canadians who are impacted by what can be referred to as neural diverse disabilities, or cognitive impairments. Diagnoses such as ASD, ADHD, FAS, and mental health conditions among others have historically faced challenges to fit their complex effects into these ambiguous boxes.

Applications can be rejected or delayed for not meeting eligibility mainly due to improper wording. This results in appeals or request for more information letters to be sent to the applicants’ medical practitioner, creating additional administration efforts, time and cost.

The new, more clinically relevant terms, more accurately describe and articulate the range of mental functions that are necessary for everyday life. The aim is to smooth out the application process, reducing delays, requests for more information and to improve overall access to those impacted by significant cognitive impairments.

The proposed terms include:

-

attention

-

concentration

-

memory

-

judgement

-

perception of reality

-

problem solving

-

goal setting

-

regulation of behaviour and emotions

-

verbal and non-verbal comprehension

-

adaptive functioning

-

-

Recognition of more activities in determining the amount of time spent on life-sustaining therapy and a reduction in the minimum required frequency of therapy to qualify for the DTC.

This category of the DTC was designed to recognize that Canadians facing a life-threatening condition may require therapy which is essential to support vital function and that this therapy can result in significant impacts on their everyday living. This section of the form was another contestable area of the DTC application as the restrictive limits left many Canadians who were facing life threatening conditions or extreme medical fragility, without the support of the credit and its gateway programs.

The current rules require that the therapy be delivered at least 3 times per week and that the weekly average time taken was at least 14 hours. The issue is some activities which are essential to the therapy are excluded in determining time spent receiving treatment. This includes activities related to dietary, exercise, restrictions, regimes (even if those restrictions or regimes are a factor in determining the daily dosage of medication), travel time, medical appointments, shopping for medication and recuperation after therapy. These activities which can be essential to the prescribed therapy can take a significant amount of time and can greatly impact the ability to engage freely and equitably in activities of daily life.

To recognize that these aspects of therapy are essential and in fact do take time away from everyday normal life the budget proposes to:

-

allow reasonable time spent determining dietary intake and/or physical exertion to be considered when determining the dosage of daily medication

-

clarify that the exclusion of time for medical appointments does not apply to appointments to receive therapy or to determine the daily dosage of medication

-

allow reasonable time spent on activities that are directly related to the determination of the amount of; medical food or medical formula, or to limit intake of a compound that can be safely consumed as part of the therapy

-

the exclusion of time for recuperation after therapy does not apply to medically required recuperation

-

where an individual is incapable of performing their therapy on their own due to the impacts of their disability, the time reasonably required by another person to assist the individual in performing and supervising the therapy would be allowed to be counted.

-

the requirement that therapy be administered at least three times each week be reduced to two times each week.

-

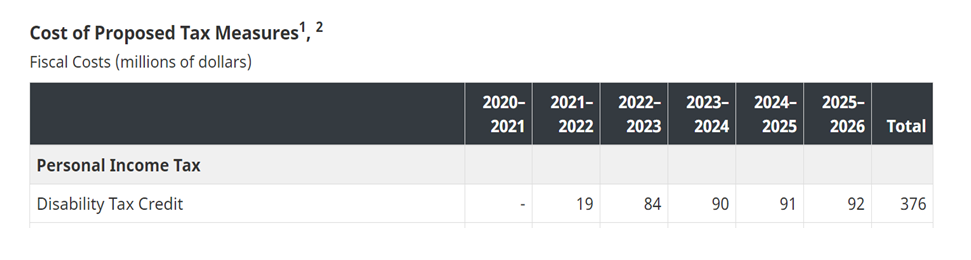

The annual estimated costs of these changes over the next five years are provided in the chart below and total $376 million in the form of non-refundable tax credits to Canadians living with a severe disability or condition or the families and caregivers that support them.

Many Canadians living with a disability are in income brackets that are essentially non-taxable and, as the credit is non-refundable in nature, it does not provide financial relief to these individuals. The DTC does however act as a gateway providing access to other tax-related credits, benefits and measures. Most notably the Registered Disability Savings Plan, the Child Disability Benefit and the disability supplement to the Canada Workers Benefit.

These proposed changes are a step towards increasing financial security for Canadians living with a disability. In 2019 the Federal Disability Advisory Committee released a report on removing barriers and improving access to the DTC and RDSP. It contained 42 separate recommendations, so it would appear there is still more work to be done.