DISABILITY & COVID SUPPORTS

October 2020

Audrey Veltri, IG Wealth Management

Prior to the pandemic Canadians with disabilities and their families experienced drastically higher than average rates of underemployment, unemployment, and poverty. COVID has widened this gap and created an even larger financial burden for persons with disabilities and their families. The onset of COVID-19 has led to increased hardship in the healthcare system, the workplace, the community, and even in the home, due to limited access to disability supports.

In June 2020 the Federal Government announced $550 million in financial support to people with disabilities and their families as they navigate new costs and challenges due to COVID-19. This announcement is the largest investment in people with disabilities by the Federal Government since the Registered Disability Savings Plan (RDSP) in 2008.

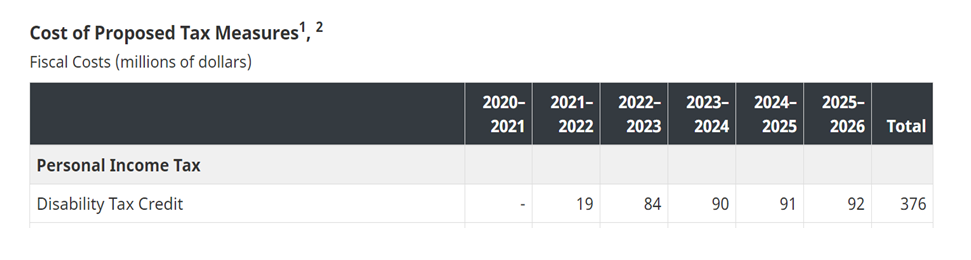

One of the announcements included a one one-time, non-taxable and non-reportable payment of $600 to Canadians who are eligible for the Disability Tax Credit (DTC), including families that receive the Child Disability Amount. The requirement to receive this payment is to hold a valid DTC certificate and that the certificate was applied for prior to September 25, 2020. Provided you meet the listed requirements the payment will automatically be provided, and those eligible will start receiving payments October 30, 2020.

This highlights the shortcomings of using the Disability Tax Credit as a mechanism to recognize, allocate, and distribute funds to Canadians with disabilities. To qualify for the DTC, applicants must navigate a complex screening process and have a medical professional certify their disability status, this can be particularly arduous for individuals with intellectual disabilities. Furthermore, despite CRA attempts to limit the cost, the DTC evaluation process can carry substantial costs, making it inaccessible to those who need it most. Statistics reveal only 40% of eligible Canadians are receiving the credit, leaving 60% of Canadians living with a disability without the benefit payment. And depriving them from further financial support and programs which are accessible through the DTC, like the Registered Disability Savings Plan (RDSP).

A senate appointed committee released a report in 2019 containing over 40 recommendations to amend the DTC process, making it more accessible to people with disabilities. As of now, few recommendations have been implemented.

As Canada plans for a COVID recovery, persons with disabilities, their families and the organizations that support them look for ways to work with various levels of government to address the systemic inequity that exists across the country. And we hope for the opportunity to collaborate on initiatives that will promote financial security for all.

The credit dates back to 1944, created to address the needs of those with severe vision loss in Canada, and was later expanded to include individuals with severe disabilities. During tax reform in the 1980s, it became a non-refundable credit, as it remains today. Non-refundable status indicates that it will not generate a refund for its claimant, but rather it reduces tax owing. If you are not in a taxable position, as many with severe disabilities are not, the application of the credit has seemingly no benefit to you. However, the credit can be transferred to a caregiver, such as a parent, and be claimed. The non-refundable status of the credit is one possible factor contributing to the lower utilization of the credit, particularly in adults with disabilities. Many families are unaware of its transferable status, and more importantly unaware of the many other benefits aside from tax relief that it provides.

The DTC also serves as an entry point for other government programs, the Child Disability Benefit and the Registered Disability Saving Plan. The CDB provides a monthly tax-free payment to eligible families supporting a disabled individual under age 18. For the period of July 2019 to June 2020, there is the potential to receive up to $2,832 ($236.00 per month) for each child who is eligible for the DTC. The RDSP offers up to $90,000 in government grants and bonds towards the long term financial security for persons with disabilities. An acute lack of awareness surrounds these benefits and a greater gap exists in recognizing and understanding their affiliation with the DTC.

The application process for the DTC, which is administered through the CRA, is complex and cumbersome. Eligibility criteria are unclear and fraught with subjectivity and there is an inherent lack of consistency in the assessment of eligibly. This has led to confusion for health care professionals, families, caregivers, and people with disabilities themselves when considering their potential qualification and applying for the DTC. The application process and eligibility criteria are main focus points for the Disability Advisory Committee which was recently reinstated in November of 2017. In the DAC report released earlier this year, the committee made 41 recommendations to improve the DTC program.

I’d like to acknowledge that I feel fortunate to live in a country that has a program like the DTC which recognizes the potential financial impacts of living with a disability. At the same time, I have experienced and frequently encounter many challenges in accessing this vital measure for Canadians with a disability. There are wide-ranging concerns and potential solutions. Clarifying eligibly criteria is a significant starting place for reducing barriers. Decoupling the DTC from other benefits, such as the RDSP and switching administration of the program from the CRA to ESDC Employment and Social Development Canada have also been proposed by some policy groups. I have included links to the various policy papers available on the DTC, including the link to the Disability Advisory Committee’s recent report and recommendations.

If you are not currently eligible for the DTC and are uncertain whether this program could benefit you or someone you care about I encourage you to explore your options and the role the credit could play in strengthening your current situation and creating a secure future.

If you or someone you care about has questions about this article or could benefit from disability supports and planning for the future, I am here to help.

We provide guidance to families supporting dependents with a disability and family stewards to ensure effective access to all financial programs and government supports. We implement strategies to protect these supports and guide families through periods of transition and at all life stages. We create solutions that transcend generations, so families can enjoy today, embrace tomorrow and secure a comfortable, safe and healthy future for the whole family.

Partner at Pinnacle Accounting and Finance, Crystal strives to use her skill and knowledge to offer solutions and bring peace of mind to her clients. Having gained 17 years of accounting experience through work in public practice, industry and as a CFO, Crystal is able to relate her own practical experience to her client’s needs. She enjoys analyzing each client’s unique situation and putting together an optimal tax plan to help them reach their goals. Born and raised in Calgary, Crystal enjoys volunteering in the community and serves on the boards of local nonprofit organizations.

Partner at Pinnacle Accounting and Finance, Crystal strives to use her skill and knowledge to offer solutions and bring peace of mind to her clients. Having gained 17 years of accounting experience through work in public practice, industry and as a CFO, Crystal is able to relate her own practical experience to her client’s needs. She enjoys analyzing each client’s unique situation and putting together an optimal tax plan to help them reach their goals. Born and raised in Calgary, Crystal enjoys volunteering in the community and serves on the boards of local nonprofit organizations.